Firm Overview

Broker

Platform

Payment Methods

Payout Methods

Instruments and Assets

Type of Instruments

Assets

Firm Rules

1. Challenge Account Rules (2-Step Evaluation)

- Phase 1:

- Profit target: 8%

- Daily drawdown limit: 5%

- Overall drawdown limit: 10%

- No time limit for completion.

- Phase 2:

- Profit target: 6%

- Drawdown limits: same as Phase 1.

- Profit share in this phase: 30%.

Upon success, traders receive funding and can earn up to 90% profit share.

- Funded Account Rules:

- Profit share ranges from 50%-90%, depending on performance.

- Risk limitations include: 1% risk per trade, 5% daily drawdown and 10% overall drawdown.

2. Instant Funding Account Rules (No Challenge)

WeMasterTrade offers instant funding accounts with no challenge requirement. Available account types include:

- 51010: Daily drawdown: 5% and overall drawdown: 10%. Profit target to be eligible for payout: 10%

- 51010-NoPC: Same drawdown rules as 51010, but no profit consistency requirement.

- 510zero: Same drawdown rules, but no profit target required.

- Customize: Tailored rules to fit individual trader needs.

Reset Discount: WeMasterTrade offers a 30% discount for traders who wish to reset the evaluation challenge after a failure.

Minimum Trading Days: There is no minimum trading day requirement, providing flexibility for traders to take action at their own pace.

Risk Consistency (on funded accounts): Once funded, traders must maintain 1% risk per trade, promoting disciplined risk management.

News Trading: Allowed, there are no restrictions around news events, enabling traders to trade freely during announcements.

Expert Advisors (EAs): Allowed

Overnight & Weekend Holding: Permitted, traders are allowed to hold positions overnight and over weekends, giving maximum flexibility.

Payout Policy

Profit Split

- Traders receive a profit share of up to 90%.

- High-performing traders may qualify for higher splits as they advance in the scaling plan.

Profit Withdrawal Rules

For eligible accounts (51010, 510zero, Standard, Customize,…), profit share increases based on the number of withdrawals completed:

- 1st withdrawal: 50% of profits

- 2nd withdrawal: 70% of profits

- 3rd withdrawal onward: 90% of profits

For the 51010-NoPC account, profit share depends on trading risk levels. Detailed criteria are available on the official WeMasterTrade site.

Payout Frequency

- WeMasterTrade allows traders to request payouts shortly after their first profitable trade.

- Withdrawals are processed daily, with an average turnaround of about 48 hours.

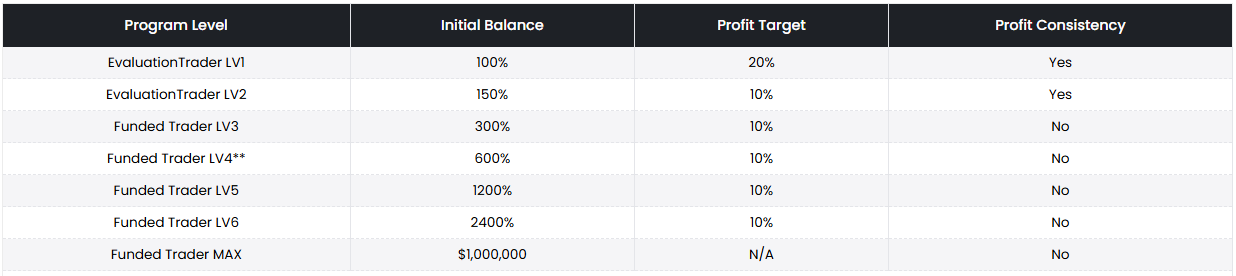

Scaling Plan

WeMasterTrade offers a structured Scale Up Plan that allows traders to gradually increase their account size as they meet performance goals. Each level comes with clear profit targets and balance multipliers. Offers scaling plan with up to 1 million in virtual funding.

Key Notes

- To advance beyond Level 2, traders must achieve at least 2 successful payouts.

- At every stage, traders receive a personalized trading agreement.

- Currently, the scale-up plan is not applied to the 51010NoPC program, but it may be introduced in the future.

This scaling pathway provides traders with the opportunity to grow their account from the initial evaluation stage all the way up to managing $1,000,000 in capital.

Risk Warning

Reviewpropfirm is a financial media platform, with information displayed coming from public networks or uploaded by users. Reviewpropfirm does not endorse any trading platform or variety. We bear no responsibility for any trading disputes or losses arising from the use of this information. Please be aware that displayed information may be delayed, and users should independently verify it to ensure its accuracy.