Looking for prop firms allow EAs so you can trade using your own automated strategies? This guide from ReviewPropfirm lists the best prop firms allow EAs use, so you can automate your trades without having to follow strict rules that keep you from doing what you want. Read on to find out which prop firms allow EAs and can help you become more successful in trading.

What are Expert Advisors (EAs)?

Automated trading programs called Expert Advisors (EAs) are developed to work with the MetaTrader platform. They let people trade automatically, using set trading strategies, without any help from a person. The main goal of EAs is to stop people from making decisions based on their feelings, help them manage their time better, and take advantage of market patterns that are hard for people to see all the time.

Most brokers, especially prop firms, see EAs as tools that can help make strategies better, make trading more consistent and make it easier to get the same results in both evaluation accounts and real money accounts.

There are various kinds of EAs, from short-term day trading systems with a lot of trades to trend-following EAs that may hold long positions and manage risk in very complicated ways. The level of difficulty of an EA also depends on how capital is managed and how much margin is needed. Some EAs operate well on smaller accounts but may not fit with the tight risk rules of a prop firm.

When using EAs, you need to think carefully about the quality of the source code, the reliability of the backtesting results and most significantly, how well they can adapt to changing market conditions.

Why Do Some Prop Firms Not Allow EAs?

Pressure on Infrastructure and Liquidity

A lot of trading happens with EAs, which puts a lot of stress on trading servers. When the market is very volatile, automated order opening and closing by EAs can cause slippage, delays in execution, or problems with the pricing systems of liquidity providers that are connected to them. This could change the results of evaluations and risk assessments for a whole group of traders, which is why not all prop firms let people use EAs.

Software Operational Risks

EAs are often developed by third parties or programmed by traders themselves, which means they may contain bugs or unstable connections. Even a minor coding error can trigger a series of incorrect trades, disrupt capital management and cause substantial losses. To reduce these risks, even some prop firms allow EAs usage impose strict checks and real-time monitoring.

Fairness and Competition

Prop firms want to make sure that all traders have a fair chance. If a specific group uses a highly optimized EA, they might do better than manual traders, which makes the funding and selection process less clear. Some prop firms make users show the EA’s source code or limit the kinds of EAs that can be used.

Safety and Conformance

Adding an EA with deep access capabilities to a trading platform can make it less secure. Reputable prop firms use a number of security measures, such as two-factor authentication, IP restrictions, sandbox testing and regular audits. Local or regional rules can also say whether EAs are allowed, especially if trade execution needs to be clear and there needs to be a lot of reporting.

Market Adaptability

Markets are always changing, yet many EAs are only good at using past data. EAs that are too rigid often have a hard time adjusting to sudden changes in the market or very high volatility. Some prop firms that let you use EAs push for hybrid models that mix automatic and manual trading so that they can be more flexible.

To succeed in prop firms allows EAs, traders should establish a clear strategy combining automatic and manual execution, analyze their EA’s source code and ensure their risk management meets the prop firm’s standards.

This is why many traders specifically search for prop firms allow EAs, ensuring they can fully automate strategies.

Top Prop Firms Allow EAs

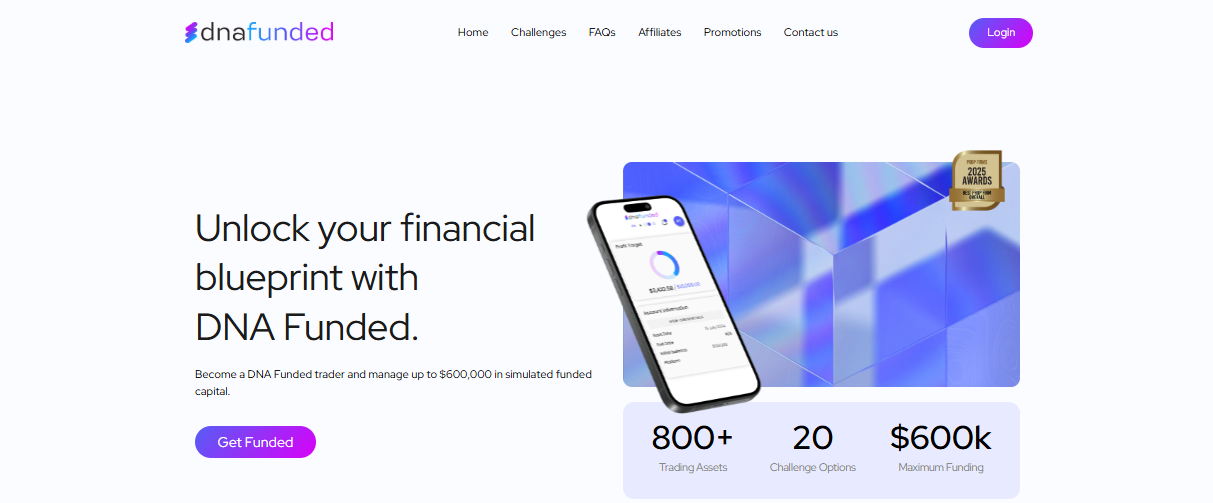

DNA Funded

Many algorithmic traders like DNA Funded. It works with DNA Markets, an ASIC-regulated broker that is known for having a trading infrastructure that is as good as what professionals use. Traders have access to a lot of tools, such as more than 800 financial instruments and virtual capital allocations of up to $600,000.

The prop firm uses TradeLocker, which is a platform that was made just for algorithmic strategies. TradeLocker works with TradingView and gives you access to powerful charts and hundreds of technical indicators based on data from more than 2 million traders. DNA Funded is among the prop firms allow EAs, giving traders the ability to run automated systems on funded accounts.

There are three options for participants: a one-step, two-step, or sped-up 10-day evaluation process. You can also get other enhancements, such raising profit splits to 90% and shortening payout cycles to every 7 days.

But other trading methods are not allowed, including as high-frequency trading, latency arbitrage, news-driven scalping and reverse hedging between accounts.

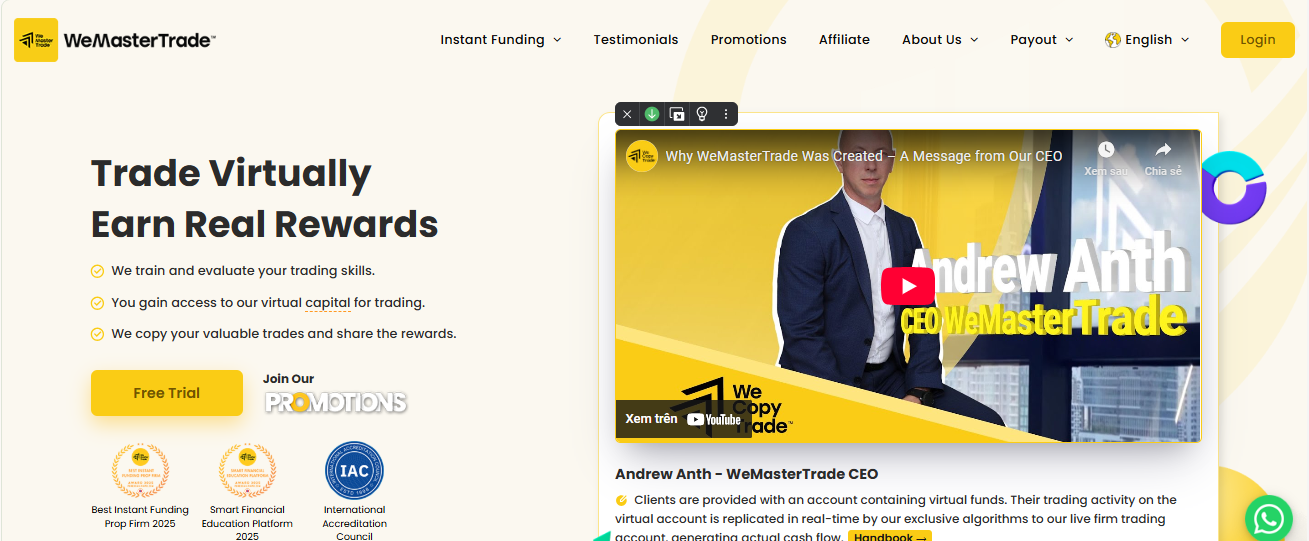

WeMasterTrade

WeMasterTrade emerged as a groundbreaking rhythmic funding platform, aiming to provide both capital and a testing environment for traders looking to apply EAs in trading. One of the best things about WeMasterTrade is that it focuses on testing automation capabilities through distinct evaluation steps, starting with simulation testing and moving on to real-account testing with less risk.

They have an EA evaluation system that works in all kinds of market conditions and they could tell traders to change some settings to make sure the prop firm’s capital is safe. WeMasterTrade often spends time teaching traders how to use EAs to their full potential and how to deal with risk when it comes to financing.

As long as performance testing stays reliable and risk management stays in place, WeMasterTrade will encourage traders to add more assets to the EA’s portfolio. Another good thing about WeMasterTrade is that you can change how much manual trading you need, so you don’t have to rely on automation all the time. This helps you find a balance between people and tools. This works well with EAs because they can be used with the trader’s market analysis to make a trading environment that lasts.

Top Tier Trader

Top Tier Trader began in 2021 and quickly became very popular with algorithmic traders. It is now one of the best prop firms for bots. Traders who use automation are quickly becoming interested in the prop firm because it offers a profit split of up to 90%.

It has a way to evaluate algo-focused strategies that sets realistic profit goals and doesn’t have any set time limits. This gives automated systems the freedom they need to do their best work.

Top Tier Trader has its own TradeLocker platform, which has a lot of automated features, such as dynamic stop-loss adjustments, position scaling and full exit management. The prop firm avoided the problems that many others had when MetaTrader support dropped by adopting TradeLocker early.

ThinkCapital

ThinkCapital is a global prop firm that is backed by a broker. It gives algorithmic traders a solid platform to carry out their plans without any problems. MT5 is still a popular choice for traders from other countries, but ThinkTrader is a platform that US users can use to do in-depth analysis and easily set up automation.

Through ThinkMarkets, ThinkCapital also gives you access to institutional-grade technology, a top liquidity network and powerful API solutions. This system makes it very easy to connect and run complicated automated strategies.

Traders can also upgrade their accounts with add-ons like Expert Advisors, profit sharing up to 90%, weekly payouts and even the ability to trade around news releases.

How to Choose The Best Prop Firms Allow EAs

To trade well with prop firms allow EAs, you need more than just a powerful tool. You also need to know how to combine it with the prop firm’s capital management and your own trading style. To get the most out of it, you should pay attention to these things:

- Backtest: To do a backtest, you need to have a lot of historical data that covers different market phases. Don’t just test one currency pair or time frame; test the EAs on a variety of time frames and markets to see if they can handle more.

- A clear plan for managing capital: Decide how big each order can be, set limits on daily, weekly and monthly losses and make sure there is a way to stop orders when the EA isn’t working right. Use EAs with the prop firm’s risk management tools, such as drawdown alerts and the option to automatically close orders when risk levels rise above a certain point. Even though the EAs can run on their own, it’s still a good idea to keep an eye on them at sensitive times.

- Reporting and data storage: Ensure the EAs has a complete logging system, the ability to recover from issues and saves the entire trading process. This helps you re-evaluate performance, detect common errors and optimize parameters. Detailed reports not only help you, but they also help prop firm managers see how well the EAs works and how well it fits their needs.

- Adapting to changes in the market: Markets are always changing, so an EA might do well in one cycle but not so well in the next. Be prepared to update parameters, change strategies, or add new models after each evaluation. Try out different versions of the EAs to find a good balance between risk and profit and make changes based on what the prop firm says.

In summary, to maximize the use of capital from a prop firm, you need to combine market knowledge, thorough testing and strict risk management. More importantly, your EAs must integrate seamlessly into the funding process, maintaining stability while facilitating scalability in subsequent stages.

Pros and Cons of Joining Prop Firms Allow EAs

Pros

- Consistency and speed: EA uses a smart algorithm that can quickly and equally handle orders, which is hard for people to do for long periods of time. This helps keep feelings and personal bias to a minimum, which is especially helpful when the market is unstable or news affects it.

- Testing and optimization: EAs can backtest and look at a lot of data to find possible trading trends and come up with better ways to manage risk that would be hard to do by hand.

- When the EA is running, traders don’t have to keep typing in orders. Instead, they can look at the big picture and make changes to their strategies based on general analysis and risk assessment. This lets you trade more and plan for the future.

- Continuous operation: EAs can work 24/5 or even 24/7 (in the right markets), which lets traders take advantage of chances in different time zones without having to watch them all the time.

These benefits explain why more traders are interested in joining prop firms allow EAs for long-term consistency.

Cons

- It all depends on how well the design is done: EAs work well with historical data, but they don’t work in live trading because they make mistakes about the market or don’t have good tools for managing risk.

- Less personal skill development: Traders who rely too much on EAs may not work on their money management and market analysis skills.

- Technical risks: If connections fail, software has bugs, or servers go down, orders may not go through or may be delayed. This could cause losses if there are no backup plans.

- Costs and time for development: You need to know how to program, understand the market and spend money on technology and infrastructure to build, test and improve an EA.

Prop firms allow EAs to embark on a potentially lucrative automated trading journey, where the combination of automated tools and the prop firm’s risk management can create a solid foundation for long-term performance. If you have a passion for automation, joining a prop firm allows EAs to bring in exceptional financial opportunities and skill development, helping you go further on your path to becoming a professional trader.